Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

It's the dog days of summer. There are a couple of biotech conferences coming up next week, but not much else is happening until Intel reports on July 24 and PayPal reports on July 29. Then the floodgates open with earnings reports through August, not to mention the next Fed meeting and the first guesstimate on June quarter GDP on July 30.

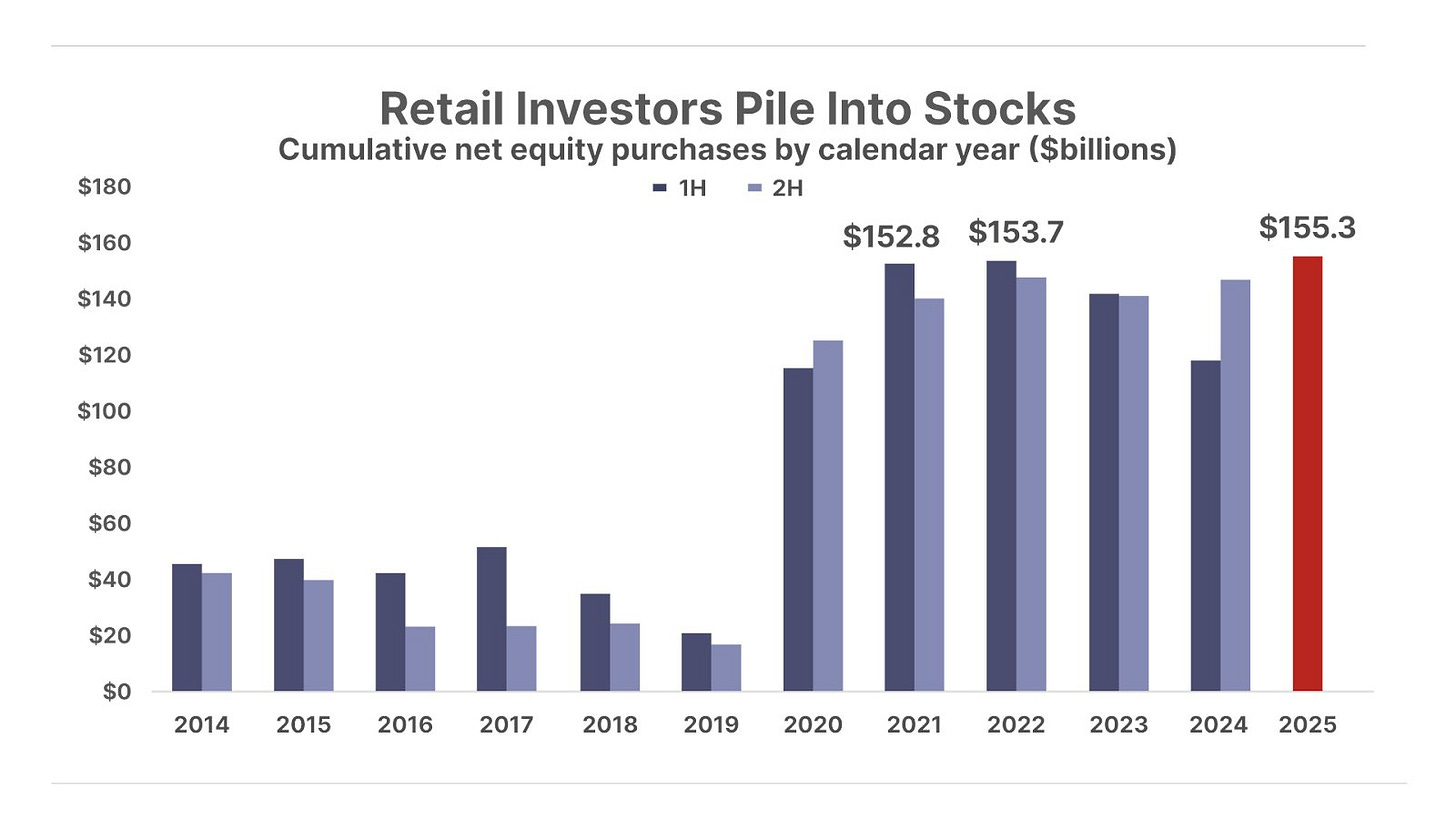

The market analytics firm Vanda Research says retail investors bought $155.3 billion worth of stocks in the first half of 2025. That was a record for the first half of any year.

h/t @vandaresearch

Yet the major sentiment indicators are a long way from overwhelmingly bullish, and there still seems to be a large amount of cash on the sidelines. It looks to me like the easy money has been made. Over the next few weeks, I'm going to review all the buy limits and target prices for the market environment going forward.

Market Outlook

The S&P 500 added only 0.2% since last Thursday, but that was enough for a new record close yesterday. The Index is now up 6.8% year-to-date. The Nasdaq Composite gained only 0.1%, again enough for a new record close yesterday. It is also up 6.8% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 3.7% on continued M&A speculation. It is still down 1.9% year-to-date, though. The small-cap Russell 2000 rose 0.6% and is up 1.5% in 2025.

The fractal dimension continues to move down toward the 55 level, which will signal that a new trend has started.

Economy

The Atlanta Fed's GDPNow model estimate of June quarter real GDP growth is still at +2.6%. The Blue Chip economists have steadily increased their forecast and probably will be up to the same area by the July 30 announcement.

Below The Paywall This Week

* * Their long game is to stay a bit behind but eventually implement whatever is proven to work

* * on the leading edge of AI

* * I've seen this play before, and it ends in tears

* * advice for people in their 20s, like my second-oldest daughter

* * partnered with the Big 12 Conference

* * a powerful wearable computer integrated into a lightweight pair of glasses with see-through lenses

* * protected by 190 architecture-specific patents

* * radiation-tolerant, reprogrammable logic solutions built for space

* * what is going to happen when the rubber band snaps back

* * copper prices surged

* * welcome diversification in difficult times

* * demonstrated robust economics

* * our company will be acquired

* * a new record high

Coming Events for Free Subscribers

All times below are EDT.

Tuesday, July 15

Consumer Price Index - 8:30am

Golden Age Portfolio Update

This was yet another very good week for the portfolio as it jumped 4.0%. We're now up 28.3% in 2025 and 130.2% since inception, with much more to come. If you've got this, great! If not, I'd be honored to help...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your watching The Illusion of Thinking Editor,

Paid subscriber or not, if you would click the ♥ symbol below, it would really help me get the word out.