Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

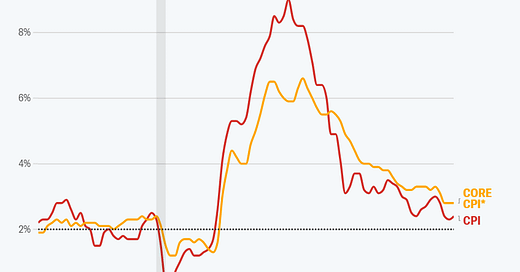

What would you do next Wednesday if you were Chairman Powell? I'd watch and wait. The labor market isn't falling apart and, just as Wall Street feared, President Trump's “Liberation Day” tariffs are accelerating inflation – not. The headline Consumer Price Index increased only 2.4% in May from last year, up a smidge from 2.3% in April (which was the lowest yearly increase since February 2021), and a measly 0.1% month-over-month compared to 0.2% in April. The consensus was expecting 2.5% YoY and 0.2% MoM.

h/t Yahoo Finance

The core CPI rose 2.8% year-over-year, the same as in April, and the same measly 0.1% month-over-month, again compared to 0.2% in April. Both were below expectations. Core goods were softer than expected, especially from weaker car and apparel prices – two categories expected to show some of the earliest impacts from tariffs. Core services were also relatively soft, with rents and Owners Equivalent Rent coming in notably lower, as I expected. So:

Really? I suspect this headline writer had already written “The Fed is in a tough spot after a hot inflation print,” which would actually have made sense. Then they swapped “another cool” for “a hot” and just went with it. Clickbait headlines are not meant to convey accurate information anyway; they are meant to sell advertising.

There really is a huge drop underway in Chinese imports entering the US - from China. However, Chinese goods are arriving anyway via loophole countries such as Vietnam, Thailand, and Indonesia. Chinese data shows that exports to the US dropped 35% in May compared with a year earlier. But during the same period, Chinese exports to six other Asian nations jumped 15%, including a 22% increase in exports to Vietnam and Thailand. I'm in the market for a small, inexpensive tracked excavator, and there is no shortage of $2,000 to $5,000 Chinese models with Briggs & Stratton motors, with parts available on eBay and Amazon.

The financial markets are slowly adopting my forecast that we will see only one Fed rate cut this year unless the labor market falls apart. I expect to see some inflation impact from the tariffs in the July and August CPI reports after companies have sold the inventories they built before the tariffs took effect.

h/t @Bloomberg

Market Outlook

The S&P 500 added 1.7% since last Thursday. The Index is up 2.8% year-to-date. The Nasdaq Composite gained 1.9% and is up 1.8% for the year. The Nasdaq 100 Index of mostly large tech companies is just 2% below its all-time high. It was down 20% just 2 months ago. Historically, sharp rallies like this were bullish.

h/t @themarketear

The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 2.2%. It is still down 6.3% year-to-date, though. The small-cap Russell 2000 booked a respectable 2.0% but remains in the hole for 2025, down 4.0%.

The fractal dimension is giving a hint that the consolidation may be over, with a new uptrend about to start, even with the S&P near its all-time high.

Economy

The Atlanta Fed's GDPNow model estimate of June quarter real GDP growth was unchanged at +3.8% as a bit more weakness in personal consumption expenditures growth was offset by a bit more strength in gross private domestic investment growth.

Dollar Death Watch

The dollar fell to its lowest level since April 2022 as commodity trading advisers piled on the shorts. They are setting up an explosive upside move.

Meanwhile, money growth is accelerating, driven by the fiscal deficit and private credit creation, even though it's already above trend. Are you bullish enough?

h/t @AndreasSteno

Below The Paywall This Week

* * finance it for two or three years at 0% interest

* * they covered battery life and AI performance

* * leading a new superintelligence lab

* * bringing advanced packaging capabilities to the US

* * over the next several years, there will be about $1.5 trillion spent on the AI buildout

* * changing the culture, embracing urgency, and introducing new initiatives

* * bringing AI and augmented reality (AR) into the real world

* * bought back another 2,774,400 shares in May

* * The RCS protocol is now available across both Android and iOS devices

* * joined the newly launched Intel Foundry Chiplet Alliance

* * There's more? Calling Tony Soprano!

* * HIV in the US is increasing, with more than 700 new cases a week

* * a good week with its best close since April 2

* * to the moon, Alice

* * In other news, she said the sun could come up tomorrow

* * I don't think either of these forces will continue

* * the right to purchase 20% of the gold produced at

* * Nothing to do but wait

Coming Events for Free Subscribers

All times below are EDT.

Wednesday, June 18

Fed Meeting - 11:00am press release; 11:30am Press conference

Thursday, June 19

Markets Closed - Juneteenth

Friday, June 20

Summer Solstice - 10:42pm

Golden Age Portfolio Update

This was a good week for the portfolio as it added 1.7%. We're now up 18.0% in 2025 and 111.7% since inception, with much more to come. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

RIP Brian Wilson

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

RIP Sly Stone

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Mendelssohn: Fantasia op. 28 in F sharp minor

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your understanding Executive Order 14215 Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.