Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

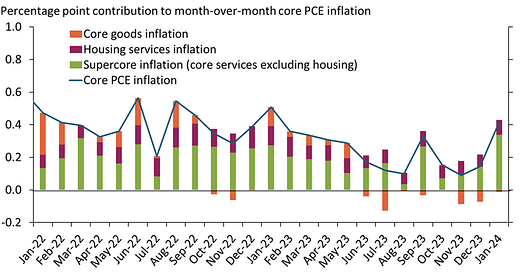

“Supercore” PCE is a measure of inflation that focuses on the prices of core services, excluding housing and energy services. It is sometimes referred to as “sticky” inflation because these prices tend to be less volatile and more persistent than other categories of inflation.

h/t Forex.com

The Fed has said they look at the Supercore PCE as an important inflation indicator. That's important right now because the Supercore has fallen to just over 1% looking at the last three months’ annualized rate.

h/t @DiMartinoBooth

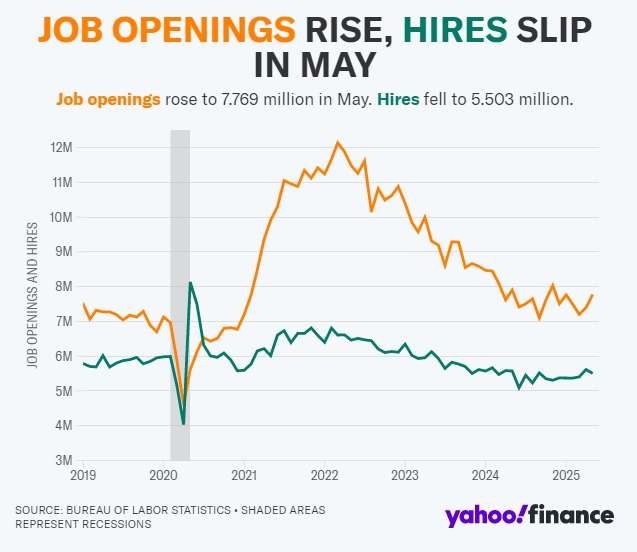

The Job Openings and Labor Turnover Survey (JOLTS) report for May showed job openings unexpectedly rose to the highest level since November 2024. The consensus expected job openings to decline to 7.3 million openings. Instead, they increased from 7.39 million in April to 7.76 million in May.

h/t Yahoo Finance

The JOLTS report also showed that 5.5 million hires were made during the month, down from the 5.61 million made during April. The hiring rate ticked lower to 3.4% from 3.5%. The quits rate, a sign of confidence among workers, moved up to 2.1% from 2% in April. Both the hiring and quits rates are hovering near decade lows, but I'm not worried about that because layoffs are also low. Yesterday's new claims for unemployment fell to a six-week low of 233,000.

I've left yesterday's June payrolls data for last, in part because it is often later revised so much in the Business Employment Dynamics reports that it's become a joke for economists and investors. (But not for traders, who pretend it means something and play their daily gotcha game.)

h/t Yahoo Finance

FWIW, June payrolls additions were 147,000, well above expectations for +110,000 and directly opposite Wednesday's report from payroll processor ADP that US private businesses reduced the number of jobs in June for the first time in over two years. ADP said companies eliminated 33,000 jobs in June, the first monthly decline since March 2023.

TL:DR – According to the CME FedWatch Tool, after Wednesday's ADP report, Wall Street thought there was a 23% chance the Fed cuts rates at the July 30 meeting and a 96% chance that at least one cut happens by the end of the September meeting. After Thursday's payrolls report, the odds of a July cut fell to 4.7% but the odds of a September cut held at 95.3%. I think they're wrong on September.

Stocks went up after Wednesday's weak ADP report because it meant the Fed was more likely to cut interest rates. Stocks went up again on Thursday after the strong payrolls report because it meant the economy isn't falling apart. When Wall Street realizes their September rate cut is a pipe dream, some traders will sell stocks because interest rates aren't cut. Other traders will buy stocks because it means the economy is solid. If you're a trader, you do you. For investors, just buy the leaders of the biggest technology changes in history - AI in the Boomberg portfolio and genetic biotech in Biotech Moonshots.

Market Outlook

In this holiday-shortened week, the S&P 500 added 2.3% since last Thursday to an all-time closing high today at 6,279.35 and a record intraday high at 6,284.65. The Index is up 6.8% year-to-date. The Nasdaq Composite also booked record highs today, gaining 2.2% from last Thursday. It is up 6.7% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 1.9% as biotech M&A activity picked up. It's still down 5.4% year-to-date, though. The small-cap Russell 2000 won the week, up 3.5%, and now is up 0.8% in 2025.

The fractal dimension is heading down to signal a new uptrend when it drops through 70. New uptrends that start from all-time highs are the most fun of all.

Economy

The Atlanta Fed's GDPNow model estimate of June quarter real GDP growth fell to +2.6%, while the Blue Chip economists are at +2.0%.

Dollar Death Watch

The dollar index (DXY) is down 10.8% so far this year. That is its worst first-half performance since 1973, when the gold-backed Bretton Woods system ended. June was the 6th consecutive declining month, matching the longest downtrend in 80 years, and the steepest six-month drop since 2009.

h/t @Bloomberg

Below The Paywall This Week

* * upgraded at Jefferies

* * we have to go with the CEO here

* * made Time's 100 Most Influential Companies list

* * closed at a record high yesterday

* * why Silicon Valley [actually, El Segundo] is taking over the military

* * more money for AI investments and stock buybacks

* * announced a stock buyback program

* * also named to Time's 100 Most Influential Companies list

* * April or May will be the peak in US production this year

* * continues to significantly exceed previous production estimates

* * heading toward a structural repricing

* * the long-term chart still looks great - the trend is intact

* * we wind up fully consolidated near the all-time highs, making the subsequent upleg much more fun

* * we all know what happens next – the uptrend resumes

* * the cheapest and easiest way to buy bitcoin

Coming Events for Free Subscribers

All times below are EDT.

Thursday, July 10

Short Interest - After the close

Golden Age Portfolio Update

This was another good week for the portfolio as it added 1.9%. We're now up 23.3% in 2025 and 121.3% since inception, with much more to come. If you've got this, great! If not, I'd be honored to share the Golden Age Portfolio with you. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your gardening throughout the season Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.