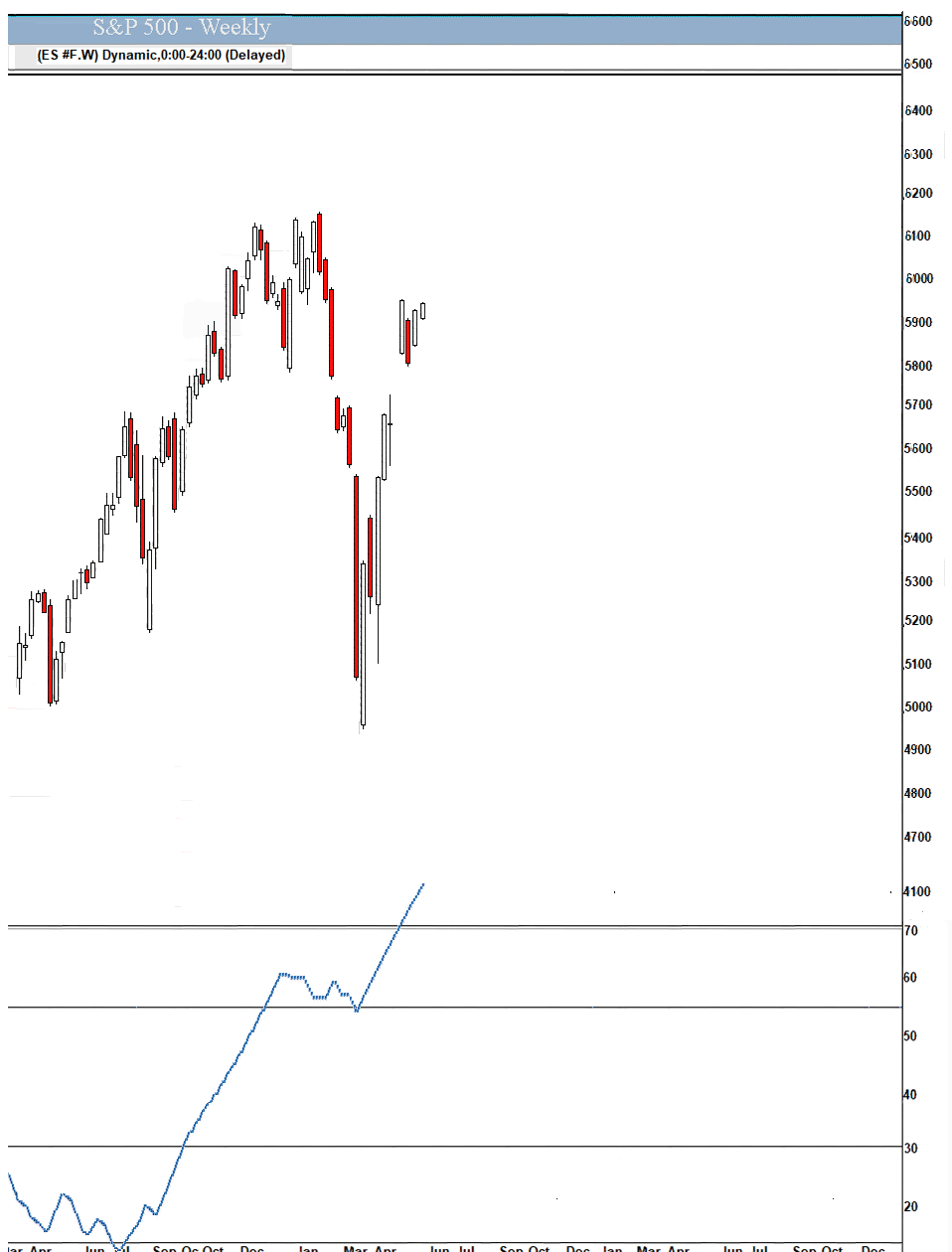

Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

This morning's May nonfarm payrolls jobs report showed the US economy added 139,000 jobs, more than the consensus expectation for 126,000. The unemployment rate held steady at 4.2%. The April number was revised down from 177,000 to 147,000. So in spite of President Trump's tariff volatility, the labor market remains pretty resilient. It has softened for sure, but there's no big retrenchment. At least so far.

h/t Yahoo Finance

What would you do if you were Chairman Powell? I'd watch and wait. The labor market isn't falling apart and, in spite of the tariffs, inflation isn't picking up. It may even be dropping.

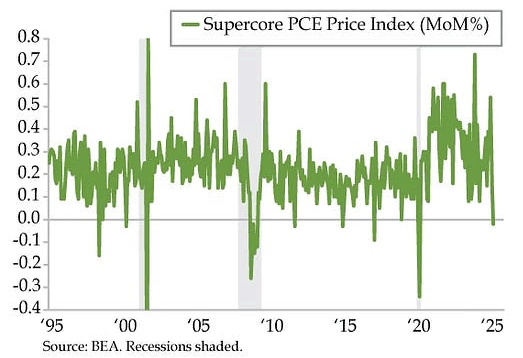

As you know, the core Personal Consumption Expenditures Index (PCE) strips out the volatile food and energy components from the headline PCE price index to provide a clearer picture of underlying inflation trends. I refer to the core PCE as the Fed's favorite inflation indicator, because they have said it is. But there's an even more refined measure, the Supercore PCE. It is a measure of inflation that focuses on the prices of core services like healthcare, education, recreation, and financial services that are less influenced by temporary supply shocks.

It excludes energy services and the large, lagging (and therefore very misleading) housing component, but it still accounts for a significant portion of core PCE inflation. The Fed thinks of this as “sticky” inflation because services prices minus housing are both less volatile and more persistent than other categories of inflation. Price increases are largely driven by factors such as wage growth (many of the services included in Supercore PCE are labor-intensive, such as healthcare, education, and personal services) and service-sector demand. It's a better measure of underlying persistent inflationary pressures in the economy, and Chairman Powell has said they look at it closely.

The Supercore PCE found itself in rare territory in April at -0.02% month-over-month, the first negative MoM reading since March 2017, excluding the initial COVID shutdown.

h/t @DiMartinoBooth

I suspect the Fed would declare victory, except they don't know if or how the ever-fluctuating tariffs will impact inflation and they are afraid the employment numbers are about to fall apart because consumers are stretched about as far as they can go. A “no problems” May payrolls number tomorrow morning translates to no change in Fed policy until things clear up...which may not happen for months.

Tuesday's Job Openings and Labor Turnover Survey (JOLTS) data unexpectedly rose in the first month that most of President Trump's tariffs went into effect. After being near a four-year low of 7.2 million in March, job openings rose slightly to 7.39 million at the end of April, above the 7.1 million consensus expectation. While openings went up a little instead of down a little, they still show a declining trend.

h/t Yahoo Finance

Again, I think this translates to no change in Fed policy until Powell gets a stronger message.

Market Outlook

The S&P 500 added 0.5% since last Thursday. As my friend Keith Fitz-Gerald noted, about 98% of S&P 500 companies have reported. 64% of them have reported positive revenue surprises, and 78% have reported positive earnings surprises. The blended earnings per share growth rate is now 13.3% year-over-year, the second consecutive quarter of double-digit growth. The Index is up 1.0% year-to-date.

The Nasdaq Composite gained 6.2% as investors realized that AI is the biggest technology change ever. It is flat for the year, giving them a graceful entry point. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 2.6% as investors realized that genetic editing is the second-biggest technology change ever. It is still down 8.3% year-to-date, giving the courageous an even more graceful entry point. The small-cap Russell 2000 booked a 1.1% gain but is down 6.0% in 2025.

The fractal dimension had another consolidation week. It didn't need it, because it is already fully consolidated, but it is nice to bank some extra energy for the next leg up without a scary drop in the Index.

Economy

The Atlanta Fed's GDPNow model estimate of June quarter real GDP slipped 4/10 to +3.8% due to weaker personal consumption expenditures growth and private domestic investment growth, but it's still far above the Blue Chip economists' expectation for +1.0%.

Dollar Death Watch

The dollar closed at its lowest since July 2023 on Monday, supporting stock, gold, bitcoin, oil, and other commodity prices. Because too many of the “often in error, never in doubt” traders are heavily short the greenback, I expect it to turn up any day.

Below The Paywall This Week

* * sales hit a record $1.281 trillion in 2024

* * The focus is to get their gross profit margin back up to 50%

* * they just signed a 20-year deal

* * the industry’s fastest speed grade of 10.7 gigabits per second, combined with up to a 20% power savings

* * Claude proposed blackmailing the engineer to stop the replacement project

* * made a strong presentation that moved the stock up

* * the company might eventually get over $1 billion in contracts

* * introduced a physical MasterCard

* * over 400 million monthly active users

* * you can ask them a question, shareholder or not

* * running the company with more financial rigor and operating discipline

* * conduct space-based research and analysis on a new cancer treatment

* * opens up significant potential to reshape our business

* * their pipeline is focused on three areas: virology, oncology, and immunology

* * I expect global oil inventories to decline in the coming months

* * they will focus on their core gas-weighted assets

* * steadily consolidating that big move up

* * Don't be fooled if the

Coming Events for Free Subscribers

All times below are EDT.

Tuesday, June 10

Short Interest - After the close

Wednesday, June 11

Consumer Price Index - 8:30am

Golden Age Portfolio Update

This was another very good week for the portfolio as it jumped 4.2%. We're now up 16.0% in 2025 and 108.2% since inception, with much more to come. You have to be in to win. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

RIP Roger Nichols, Composer

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your understanding the John George Trump-inspired 2025 energy pivot Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.