Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

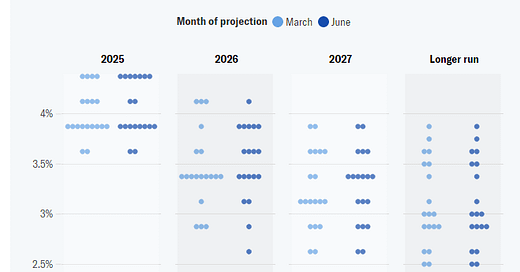

Well, you all just set a personal best – consecutive Fed days without panicking – as Chairman Powell et. al. held interest rates steady Wednesday at 4.25%-4.50% for the fourth meeting in a row since last cutting in December. They kept their projection for two rate cuts this year, which is two more than we're likely to get unless the labor market falls apart.

h/t Yahoo Finance

They changed the language that previously said “the risks of higher unemployment and higher inflation have risen” to “Uncertainty about the economic outlook has diminished, but remains elevated.” That sounds a little more positive, but at the same time they increased their estimate of the core Personal Consumption Expenditures (PCE) Index from 2.8% to 3.1%, and cut their real GDP projection for the year from 1.7% to 1.4%. So, will the Fed cut interest rates in 2025?

Cautious Fed = cautious investors.

h/t Yahoo Finance

Data from market research firms SentimenTrader, Ned Davis Research, and Vanda shows that equity exposure remains below historical averages, with mutual funds, hedge funds, and retail traders slowly rebuilding their risk positions. BofA's latest Global Fund Manager Survey showed a sharp drop in risk appetite, with a net 28% of investors taking a more-cautious-than-normal level of risk in their portfolios.

h/t Yahoo Finance

And that, folks, is where the future buying will come from. This widespread negativity, which flipped last week's up candle to a down candle, has fully consolidated the fractal dimension - laissez les bons temps rouler.

Market Outlook

The S&P 500 lost 1.1% since last Thursday on war scares. The Index is up just 1.7% year-to-date. The Nasdaq Composite lost 0.6% and is up 1.2% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 2.0%. It is down 8.2% year-to-date. The small-cap Russell 2000 dropped 1.3% and is down 5.3% in 2025.

Economy

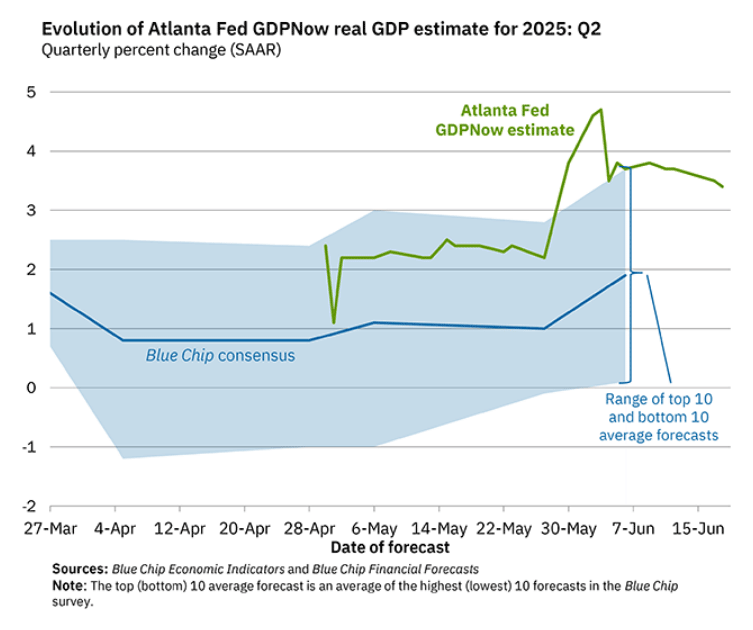

The Atlanta Fed's GDPNow model forecast for June quarter real GDP growth dropped a tenth from 3.5% to 3.4% on softer housing starts. That's still significantly higher than the consensus. The message to the Fed: In spite of higher interest rates and tariff tantrums, the economy is coping.

Below The Paywall This Week

* * seeing near-term sales strength

* * four significant appointments in sales and engineering

* * finally is monetizing

* * reports earnings next week

* * a major supplier to the humanoid robot market

* * _____ is another success

* * use the cash for AI investments and more stock buybacks

* * 26.58% of the assets are in Elon Musk companies

* * got FDA approval

* * a face-ripper 11%+ rally

* * further destabilization of Iran could lead to significantly higher oil prices sustained over extended periods

* * They can switch it back and forth between uranium and rare earths

* * Gold reserves at central banks will rise over the next 12 months

* * Silver just hit a 13-year high

* * One drill hole intersected 1.94 grams per tonne of gold over 60.0 meters

* * did his seventh shareholder FAQ

* * building up energy for the push to $150,000

Coming Events for Free Subscribers

All times below are EDT.

Friday, June 20

Today Was The Biggest June Options Expiration In History - $5.9 Trillion

h/t @Mayhem4Markets

Summer Solstice - 10:42pm

Wednesday, June 25

Short Interest - After the close

Thursday, June 26

March quarter GDP - 8:30am – Third estimate

Friday, June 27

Personal Consumption Expenditures Index - 8:30am – The Fed's favorite inflation indicator

Golden Age Portfolio Update

I decided to hold the proceeds of our Redwire (RDW) sale in cash for now, even though we are on very slight (~4.0%) margin. This was a flattish week for the portfolio as it eked out a 0.2% gain. We're now up 18.2% in 2025 and 112.1% since inception, with much more to come. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

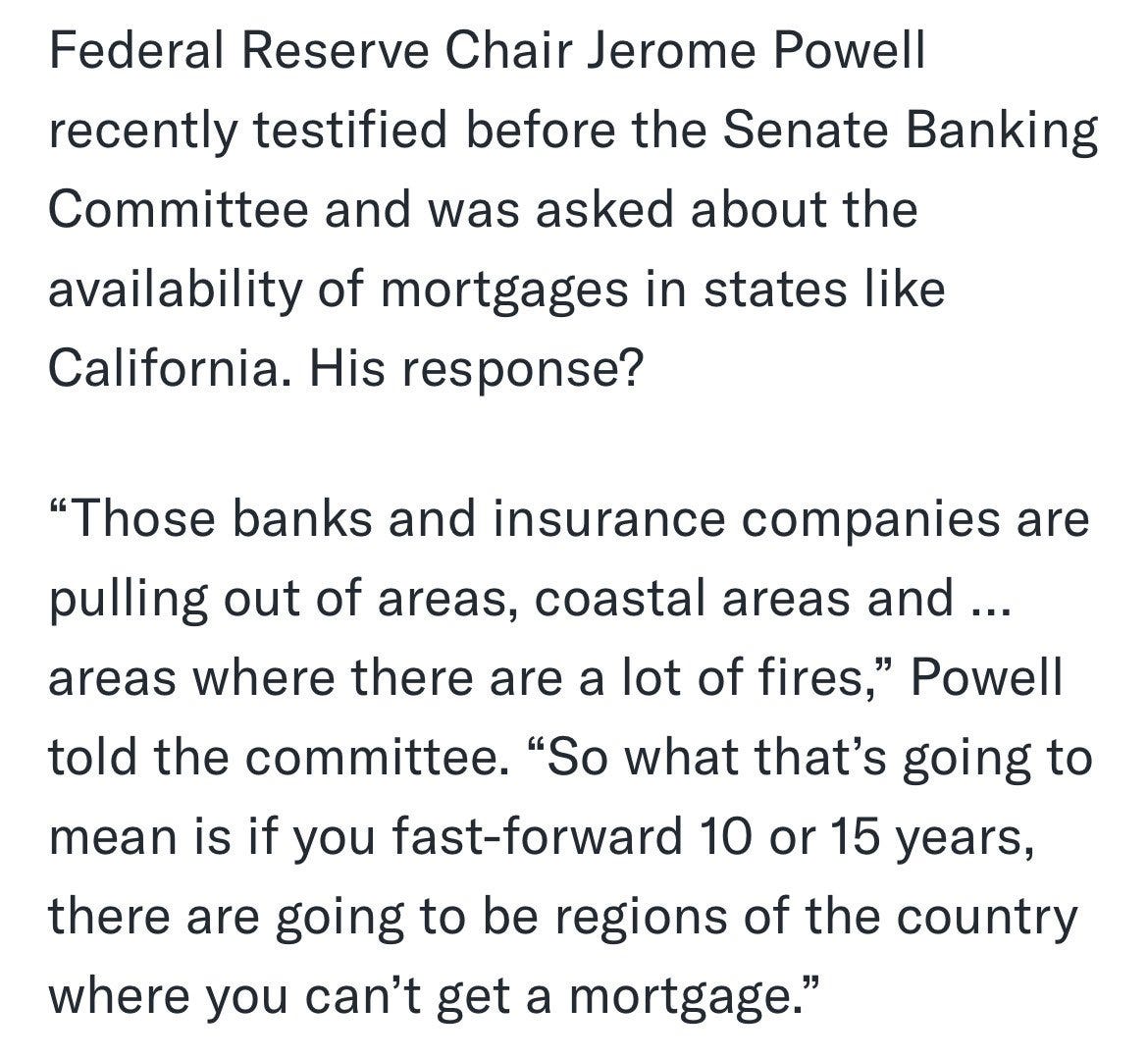

h/t @MauiBoyMacro

Which means there’s lots of real estate that’s worth significantly less if only cash buyers are able to buy. - @cherrygarciafan

Not to mention, you won't be able to get fire insurance.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

The GREATEST ORGAN PIECE EVER WRITTEN...is far WEIRDER than you think

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your hearing about the Geophysical Event Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.