Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

The headline April Consumer Price Index was +2.3%, the slowest increase since February 2021 and a tenth below both market expectations and the March number, even though many of President Trump's tariffs were in effect. Month-over-month, prices increased 0.2%. That was better than the 0.3% estimate but worse than the 0.1% monthly decline in March. As usual, the lagging Shelter category accounted for about half of the increase.

The Fed's favorite inflation indicator, core inflation excluding food and energy, rose 2.8% year-over-year, the same as in March. It was up 0.2% month-over-month, better than the 0.3% estimate but worse than the 0.1% monthly increase in March. I don't think this report will change the Fed's attitude of watchful waiting to see what the impacts of tariffs are on inflation and the economy.

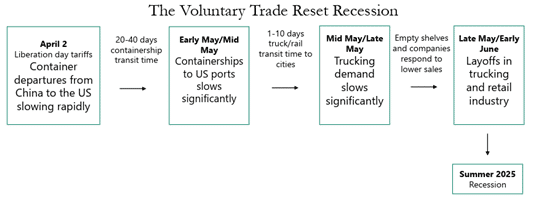

Those expecting a recession have varying ideas of where it would start and how it would unfold. Harris Kupperman suggested this:

h/t Kuppy

I am mostly watching the weekly new claims for unemployment for a sustained rise over 250,000. That would indicate real employment weakness and a recession. Unless and until that happens, I don't think the Fed will cut – nor should they. The monthly payroll numbers continue to be untrustworthy. The latest Business Employment Dynamics report showed a net job loss of 3,000 private jobs in the September 2024 quarter.

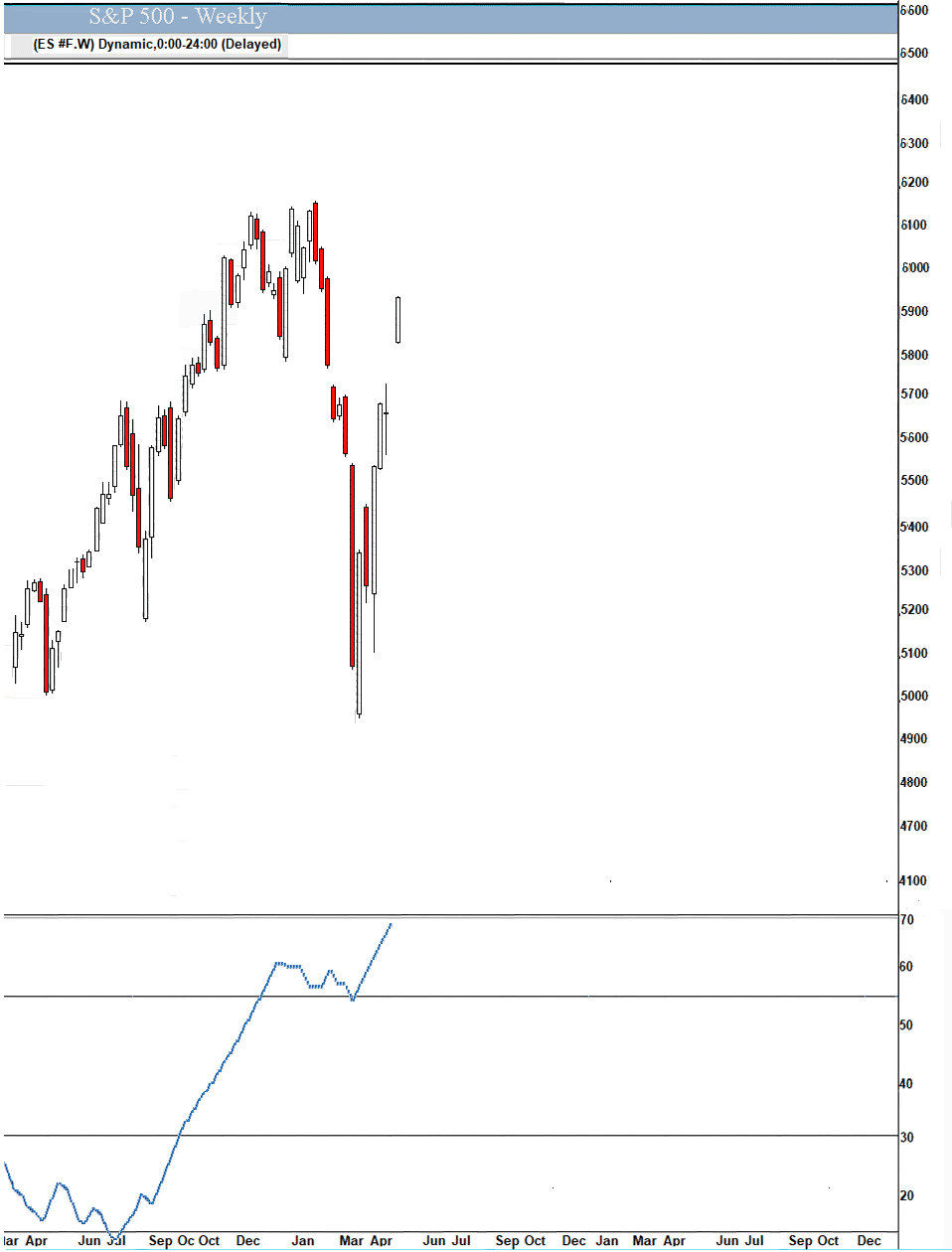

Monday saw a DeGraaf Breadth Thrust, when at least 55% of S&P 500 stocks hit a 20-day high. Three weeks ago, we got a Zweig Breadth Thrust that I wrote about. Here's what happens when we get both Thrusts within a month of each other. Higher 100% of the time after two months, and an average of 26.12% higher a year later.

h/t @SubuTrade and @dailychartbook

Market Outlook

The S&P 500 added 4.5% since last Thursday after President Trump's stunning successes in the Middle East and the expected cooling of tariff fears. The Index is now up for the year, although only by 0.6%. The Nasdaq Composite gained 6.6% but is still down 1.0% year-to-date. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 0.6% as investors looked for more cyclical companies that would benefit from a better environment. It is down 13.9% year-to-date in one of the most dramatic underpricings of future potential I've ever seen. The small-cap Russell 2000 climbed 3.5% and is down 6.1% in 2025.

The fractal dimension is nearly fully consolidated. The rally that is consolidating the Tariff Tantrum decline can fully consolidate and power a new uptrend just as it approaches the last highs. Fun.

Economy

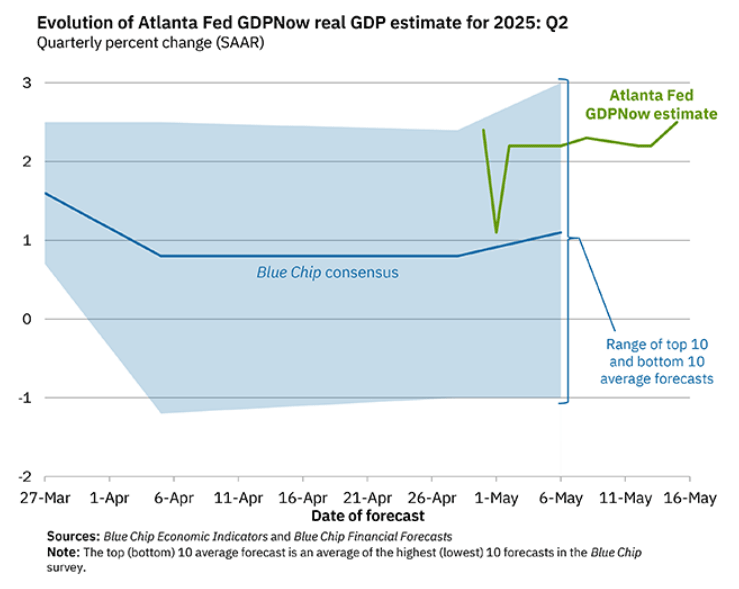

The Atlanta Fed's GDPNow model increased to +2.5% this morning due to strength in both personal consumption expenditures and private domestic investment growth. The stock market is going to be pleasantly surprised.

The FDA announced the completion of their first AI-assisted scientific review pilot and an aggressive agency-wide AI rollout timeline to scale the use of AI internally across all FDA centers by June 30. FDA Commissioner Makary said: “I was blown away by the success of our first AI-assisted scientific review pilot. We need to value our scientists’ time and reduce the amount of non-productive busywork that has historically consumed much of the review process. The agency-wide deployment of these capabilities holds tremendous promise in accelerating the review time for new therapies.”

They were able to perform scientific review tasks in minutes that used to take three days. Welcome to the 21st century, FDA! Anything that speeds up the review process is good news for every biotech company. I've written much more on the FDA and AI in this week's Biotech Moonshots. Read it HERE – it's free.

Below The Paywall This Week

* * thinking of increasing prices, according to the Wall Street Journal. I doubt it.

* * That's what I wanted to hear!

* * It will not surprise you to learn that the study was performed by

* * remains under strong demand with very good pricing

* * This will bring billions of dollars of revenue over the next few years.

* * ranked among their top-performing programs

* * they expect a very strong June quarter

* * the stock is selling for a Price/Earnings ratio of only 5.1x

* * a multi-year strategic partnership with Microsoft

* * our full-year outlook for solid revenue growth, non-GAAP profitability, and positive cash flow

* * finished March with a $6.0 billion pipeline of potential contracts

* * a sharp improvement in reported earnings

* * President Trump's tariffs and policies towards drug companies haven't affected them much

* * They have to be kidding

* * going to take advantage of high European natural gas prices

* * speed nuclear reactor deployments

* * a necessary consolidation of the last upturn

* * remains the cheapest and easiest way to buy bitcoin

* * remains the cheapest and easiest way to buy ethereum

Coming Events for Free Subscribers

Nothing happening.

Golden Age Portfolio Update

This was another very good week for the portfolio as it jumped 8.5%. We're now up 10.6% in 2025 and 98.4% since inception, with much more to come. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Russian Philharmonic tango?

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your looking at next level pond design Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.