Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

There are two things I realized about President Trump before his first term started in 2016:

1. In a complex situation, he likes to shake everything up, see where things land, and then decide what to do next.

2. He actually follows The Art of the Deal:

a. Make a ridiculously large ask

b. Pay attention to how loud they squeal

c. Reduce the ask as necessary to get more than what you wanted in the first place

It's not “nice” and certainly not subtle, but it seems to work over and over. Trump also rarely insults the person he is negotiating with or, if he does, almost immediately walks it back. Thus, when his first term started, people had been afraid that North Korea had a missile that could hit California. Trump called Supreme Leader Kim Jong Un “little rocket man” before negotiating a deal with “I have great respect for Kim Jong Un.”

In fact, “I have great respect for” is something he's said about Chinese Chairman Xi Jinping. Russian President Vladimir Putin, and pretty much everyone else he has out-negotiated. I confidently predict you will hear “I have great respect for President Zelenskyy” just after Ukraine cedes two provinces to Russia and agrees not to join NATO to end the war.

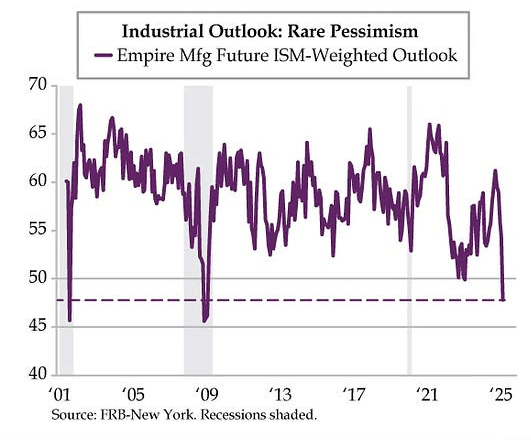

As we've seen, this negotiating style creates real confusion among many and an opportunity for Wall Street to fake confusion and issue dire warnings of disaster, with the goal of shaking loose some cheap stock to be sold in May to fund their kids' summer camps. We do see real confusion among businesses that has suddenly made them very pessimistic about their future:

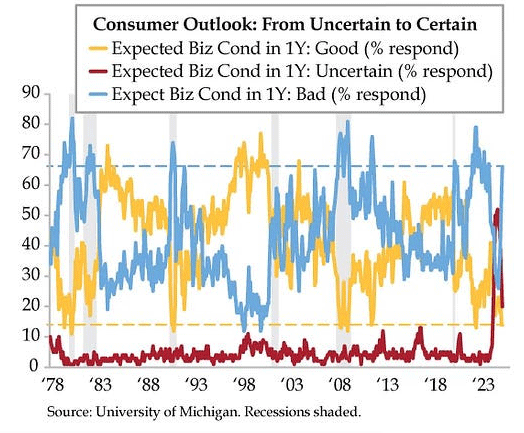

Consumers, too. The University of Michigan Consumer Survey showed a sudden jump in those expecting business conditions in one year to be bad or uncertain, accompanied by a collapse in those expecting conditions to be good.

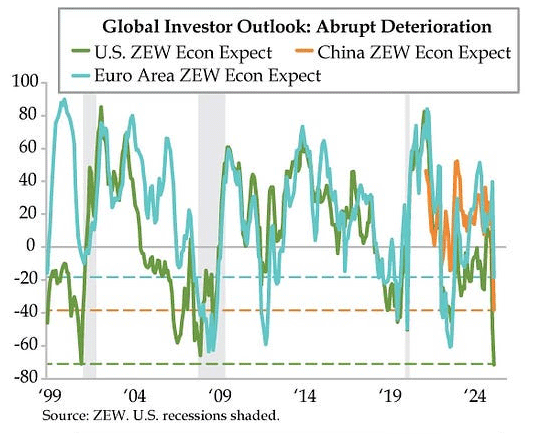

The establishment economists are equally pessimistic. For the ZEW Financial Market Survey, up to 300 experts from German banks, insurance companies, and financial departments of selected corporations have been interviewed about their assessments and forecasts for important international financial market data every month since 1991. Participants are asked about their six-month expectations concerning the economy, inflation rates, interest rates, stock markets, and exchange rates. The ZEW Indicator of Economic Sentiment is a leading indicator for the German economy and probably reflects the sentiment of most countries.

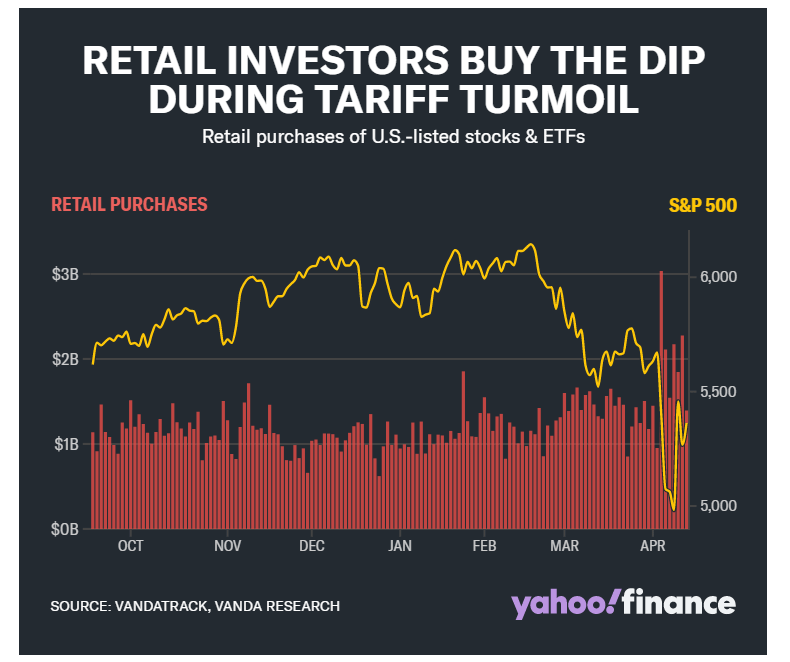

As we know, retail investors have been saying they're worried or bearish, with the CNN Fear & Greed Index bottoming at 3 (up to 21 now, still Extreme Fear) and AAII bullish sentiment bottoming at 19.3% (up to 25.4% now). But what are they doing? They're buying stocks.

h/t Yahoo Finance

Bank of America said their clients were net buyers of $8 billion worth of stock during the week of the initial tariff announcements. That was the fourth-largest weekly inflow in Bank of America's data going back to 2008. Deutsche Bank also showed global equity inflows of nearly $50 billion, the largest amount in 2025, including $31 billion flowing into US stocks.

As a contrarian, I would rather see them selling stocks, but while historically retail traders not buying the dip is a reliable sign of equity market bottoms, it's not a necessary condition for every market bottom. Sometimes they get it right.

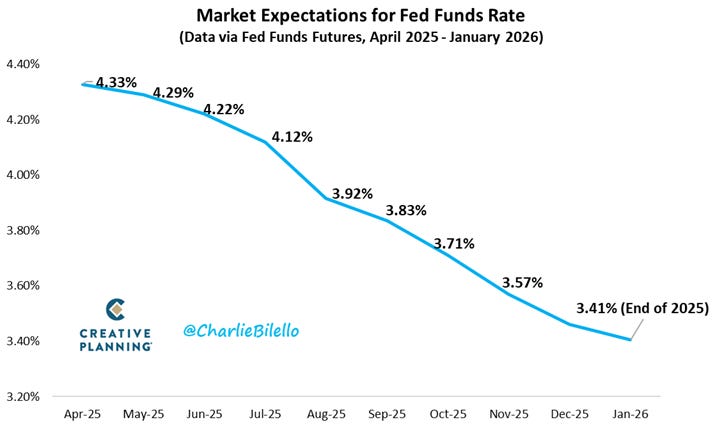

This week's report of new unemployment claims fell to 215,000, just below the consensus for 225,000 and the lowest weekly amount since early February. Even though the reported labor numbers aren't bad, all of a sudden, everyone thinks the Fed is going to cut...a lot. The market expectations for each meeting are:

* * May 7: Hold

* * June 18: 25 basis point (bps) cut to 4.00%-4.25%

* * July 30: 25 bps cut to 3.75%-4.00%

* * September 17: 25 bps cut to 3.50%-3.75%

* * October 29: Hold

* * December 10: 25 bps cut to 3.25%-3.50%

h/t @charliebilello

The yield curve has re-inverted (long rates back above short rates) during the recent market decline. That’s the EXACT opposite of what we see before an economic downturn. This also happened in the mid-1990s, and the unemployment rate remained low, no recession hit, and stocks rose for much longer than most anticipated

The intellectual underpinnings of President Trump's tariffs are in A User’s Guide to Restructuring the Global Trading System by Stephen Miran, former Senior Strategist at Hudson Bay Capital and current Chairman of the Council of Economic Advisers. TL:DR Cheapen the dollar relative to other currencies to make their exports more expensive for US consumers and make our exports cheaper for their consumers, thus shrinking the trade deficit.

Market Outlook

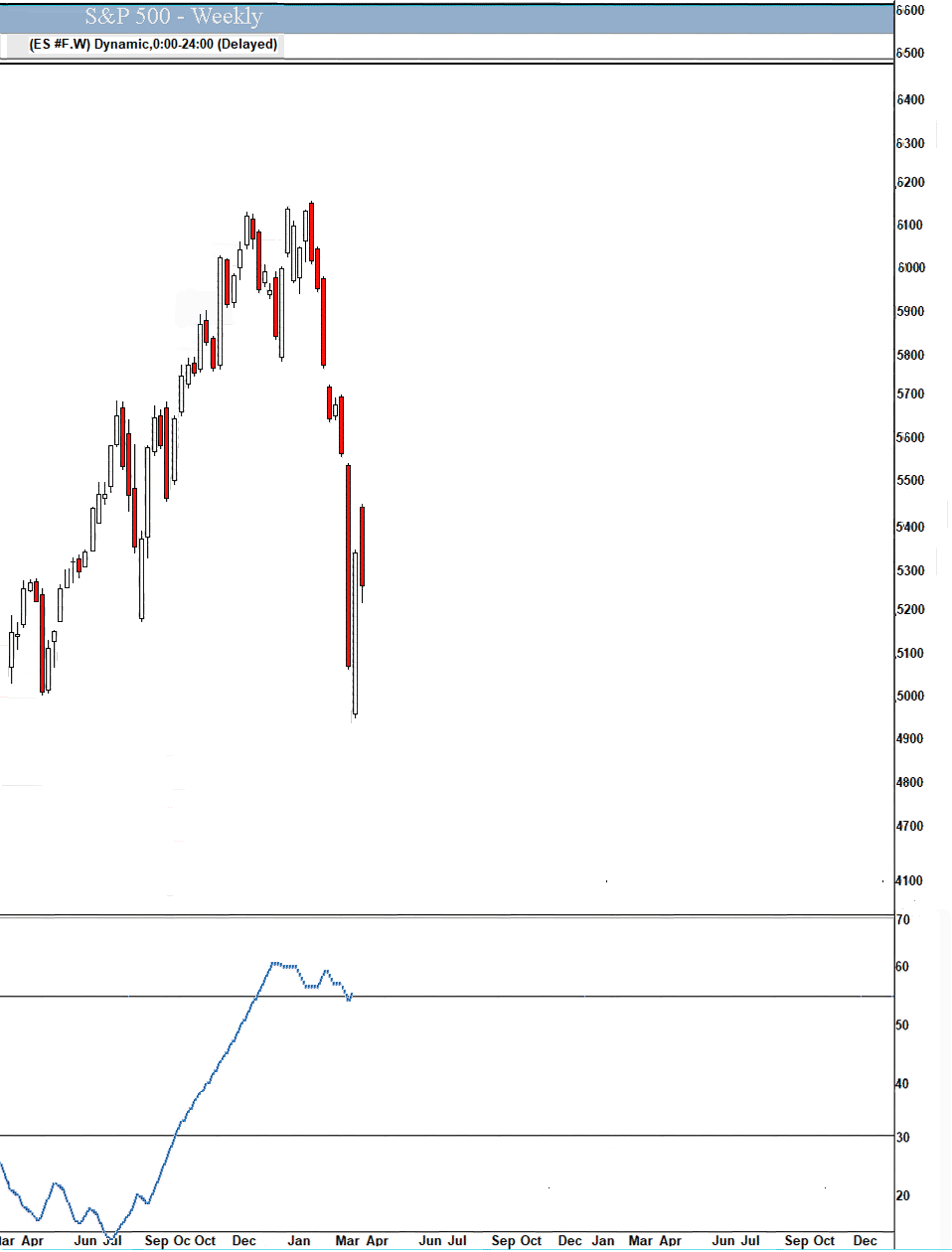

The S&P 500 eked out a 0.3% gain since last Thursday. Coming into last Friday (April 11), the S&P 500 went six straight days with a trading range of over 5%. You have to go back to 2020, 2008, and 1987 to find the last time that’s happened for four straight days, let alone six. That’s during COVID, the financial crisis, and Black Monday.

The Index is down 10.2% year-to-date. Last week's volume was the second biggest volume of the last decade. The #1 spot belongs to the August 2015 low, and the #3 spot to the February 2016 low. At the March 2020 low, the biggest volume was a bit smaller. That's another factor that supports this low being a major low.

/t @CyclesFan

The Nasdaq Composite lost 0.7% and is down 15.7% for the year. Last week, the Nasdaq 100 (NDX) had the biggest weekly volume in the history of the index - much bigger than in any of the previous crashes or bear markets. That also looks like a V-shaped bottom.

h/t @CyclesFan

The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 6.1%. Could people be catching on that biotech is dirt cheap, immune to tariffs, and will vie with AI as the most transformative technology of the next 20 years? Nah, probably not yet - it's still down 15.7% year-to-date. The small-cap Russell 2000 added 2.8% but is down 15.6% in 2025.

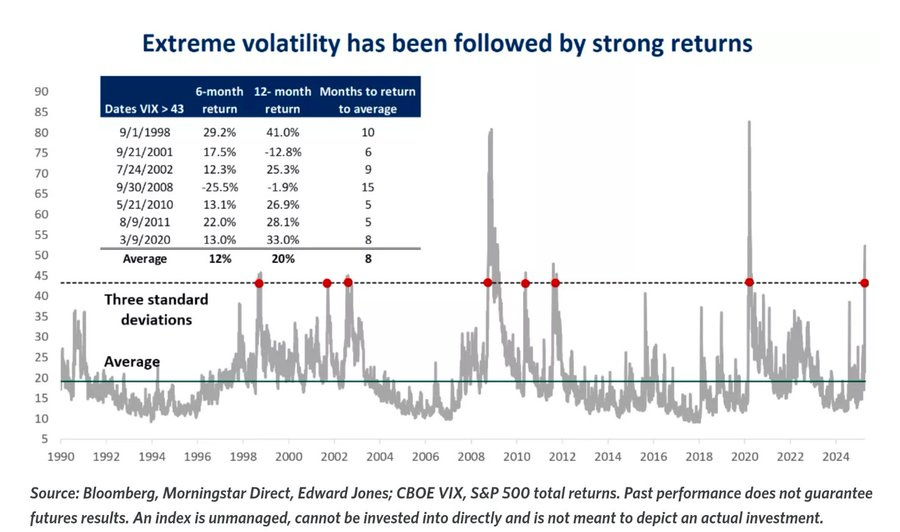

These periods of extreme volatility are difficult. I feel your pain. But in the long run, periods of extreme volatility have led to strong returns.

h/t @Mayhem4Markets

The fractal dimension extended its decisive upside last Friday and then booked a down week since last Monday. So the tentative breakthrough of the 55 level signaling a new trend has been canceled for now, and the fractals are back in consolidation mode. It sure doesn't feel like it, but the action this year has been a consolidation of the post-election rally last year. At least so far.

Economy

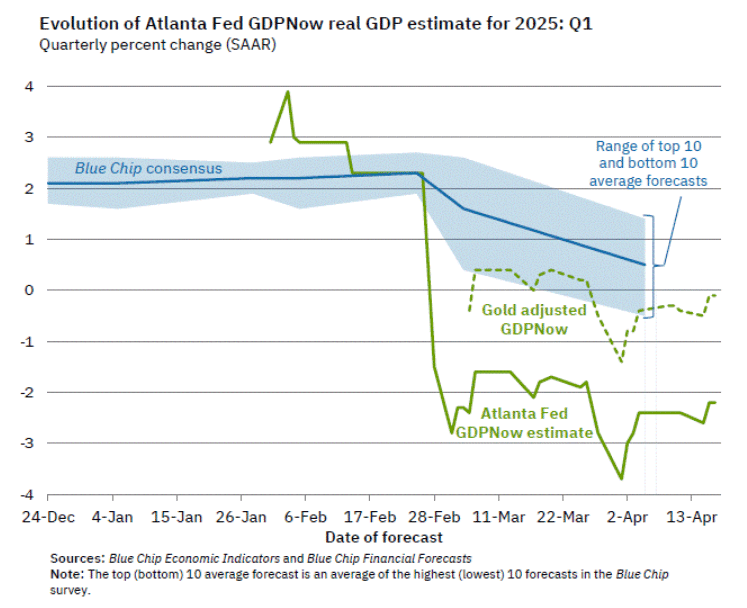

The Atlanta Fed's GDPNow model improved a tiny bit to -2.2%, with the model adjusted for gold imports also still in negative territory. The Blue Chip economists are cutting their forecast rapidly.

This week, Bank of America's latest fund manager survey of 164 participants with $386 billion in assets under management showed 82% of the respondents expect the global economy to weaken. A record number of investors intend to cut their allocation to US equities, and expectations for a US recession over the next year hit the fourth-highest reading of the past 20 years.

Dollar Death Watch

The dollar has now dropped more than 8% year-to-date, its worst start to the year since 1995.

h/t @WinfieldSmart

Below The Paywall This Week

* * Reports of my death have been greatly exaggerated.

* * cuts expenses and improves the balance sheet

* * We win either way

* * American manufacturing helps us better meet the incredible and growing demand

* * continue to allocate capital towards stock buybacks

* * the most important software company almost no one can properly explain

* * This could transform online shopping as we know it

* * we expect to see an important consumer product launch by the end of the year

* * doesn't trade at major online brokers

* * advanced automation, precision alignment, and multiple redundancies

* * participation in two multi-billion-dollar government development programs

* * resume robust growth in 2026

* * I still expect a shortage of oil

* * well-positioned to provide rare earths and – more importantly - processing in the US

* * earnings per share up sharply

* * China-led buying that has helped to shore up sentiment

* * another +38% of upside

* * another successful test of the 50-week moving average

Coming Events for Free Subscribers

All times below are EDT.

Friday, April 25

Short Interest - After the close

Golden Age Portfolio Update

This was a stand-your-ground week for the portfolio as it slipped just 0.6%. We're now down 12.7% in 2025 and up 56.7% since inception, with much more to come. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

RIP Joel Krosnick cellist extraordinaire

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your expecting them to run it hot Editor,

Paid subscriber or not, if you would click the ♥ symbol below, it would really help me get the word out.