Stocks peak about every 36 years, most recently in 1929, 1965, and 2000. This 36-year cycle can be traced all the way back to the earliest eras in recorded human history, back to Pythagoras and Plato and the Axial Age around 600BC. After each peak comes a period of decline (punctuated by bear market rallies) that typically lasts 16 years or so. Then, with the excesses of the prior bull period wrung out and investors most depressed, the next 20-year run to the next market top can begin. We're in that Golden Age now – take advantage of it!

Howdy, Bull-Riders:

It's been a week of economic news and earnings. The news paints a soft landing picture, although I still think we'll see a mild recession no matter who wins the election.

September Job Openings and Labor Turnover Survey (JOLTS): Job openings fell more than expected from August's 7.86 million to 7.443 million, the lowest level since January 2021. The August figure was revised down from 8.040 million to 7.86 million. There is much less tightness in the labor market - just a gentle cooling of labor demand. Wage growth should continue to slow and give the Fed comfort that we won't see wage-push inflation.

October Consumer Confidence: October Consumer Confidence was 108.7, well above the consensus of 99.0. September was revised up from 98.7 to 99.2. The increase in confidence was broadly based across all age groups and most income groups and featured a substantially more optimistic view about future business conditions than the prior month. That is supportive of consumer spending in the holiday season.

September quarter real GDP: GDP rose at an annual rate of 2.8%, right on the final estimate from the Atlanta Fed's GDPNow model. Personal consumption expenditures increased by 3.7% - their strongest growth rate since the March 2023 quarter and well above the prior 10-quarter average of 2.3%. That first estimate points to a strong economy and isn't likely to ramp up urgency on the part of the Fed to rapidly cut interest rates to prop up growth.

Business Employment Dynamics: The March quarter net job gains of 500 million were less than half the originally reported 1,031,000. The third revisions for the March quarter totaled 802,000 – still well above the final number.

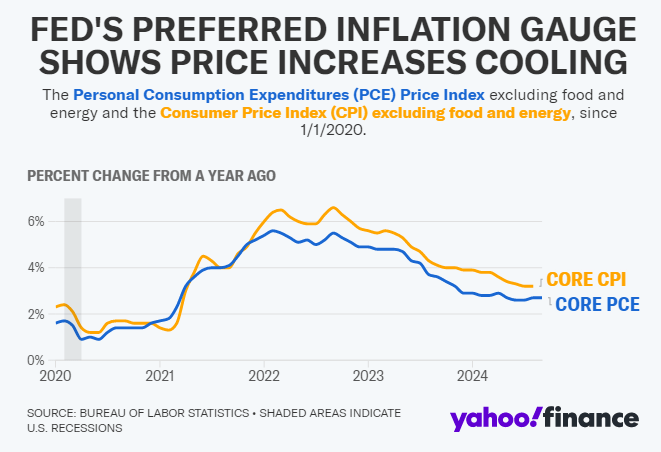

Personal Consumption Expenditures (PCE): The headline PCE rose 2.1% in September, compared with 2.3% in August, within shouting distance of the Fed’s 2% goal. But the headline on the graphic below is wrong. The Fed's favorite inflation indicator is the core PCE, which excludes volatile food and energy prices. Core PCE inflation clocked in at 2.7%, the same level as July and August. It's not dropping.

Next week, the Fed will be looking at resilient consumer spending, higher wages from a series of successful strikes, and a solid labor market. Chairman Powell will get his gradual approach to lowering rates. As I've been saying, 25 basis point cuts in November and December.

h/t Yahoo Finance

October Payrolls: Came in at +12,000, far below the +110,000 estimate, but were negatively affected to an unknown degree by hurricanes and strikes. In other words, it was a useless number. September was revised down from +254,000 to +223,000 and August was cut another 81,000 jobs. The message to the Fed is that the monthly numbers are pretty much useless, this one more than most.

Regarding the market – does anyone study accounting anymore? Say Microsoft spends $5 billion next year to buy Nvidia chips to build their AI computers. That's $5 billion of revenue to Nvidia at a 75% gross margin and maybe a 50% net profit margin or $2.5 billion of income.

However, it is not a $5 billion expense to Microsoft, or even $2.5 billion. Microsoft must capitalize that expenditure under Financial Accounting Standards Board and IRS rules, and depreciate it over (probably) five years. So it's a $1 billion hit to Microsoft's gross profit.

Taken together, Mag 7 profits have increased at least $1.5 billion – Nvidia's $2.5 billion increased profit less Microsoft's $1 billion expense. But all the headlines today were about how heavy AI spending is hurting Mag 7 profits, and both Microsoft and Nvidia closed down. Wha-a-a-t?

The right question to ask is what is Microsoft's return on investment (ROI) on the Nvidia chips? The answer is “very high.” The reason the Mag 7 are pouring billions of dollars into Nvidia chips is they get their whole investment back in a couple of years and then enjoy huge profits for years to come. Wall Street analysts fresh out of business school who have never run a company or written a line of code don't get it.

Market Outlook

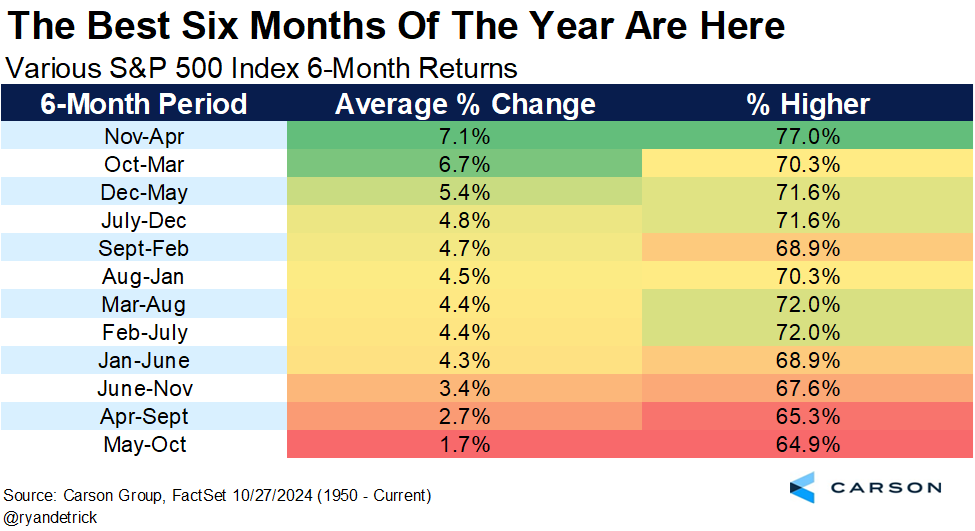

The S&P 500 lost 1.8% since last Thursday thanks to yesterday's ridiculous wipeout (see Meta discussion, below). The Index is up 19.6% year-to-date, and the best six months of the year began today:

h/t @RyanDetrick

The Nasdaq Composite lost 1.7% even after a record close on Tuesday and a record intraday high on Wednesday. It is up 20.5% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) slipped only 0.2%. It is up 8.7% year-to-date. The small-cap Russell 2000 dropped 1.0% and is up 8.4% in 2024.

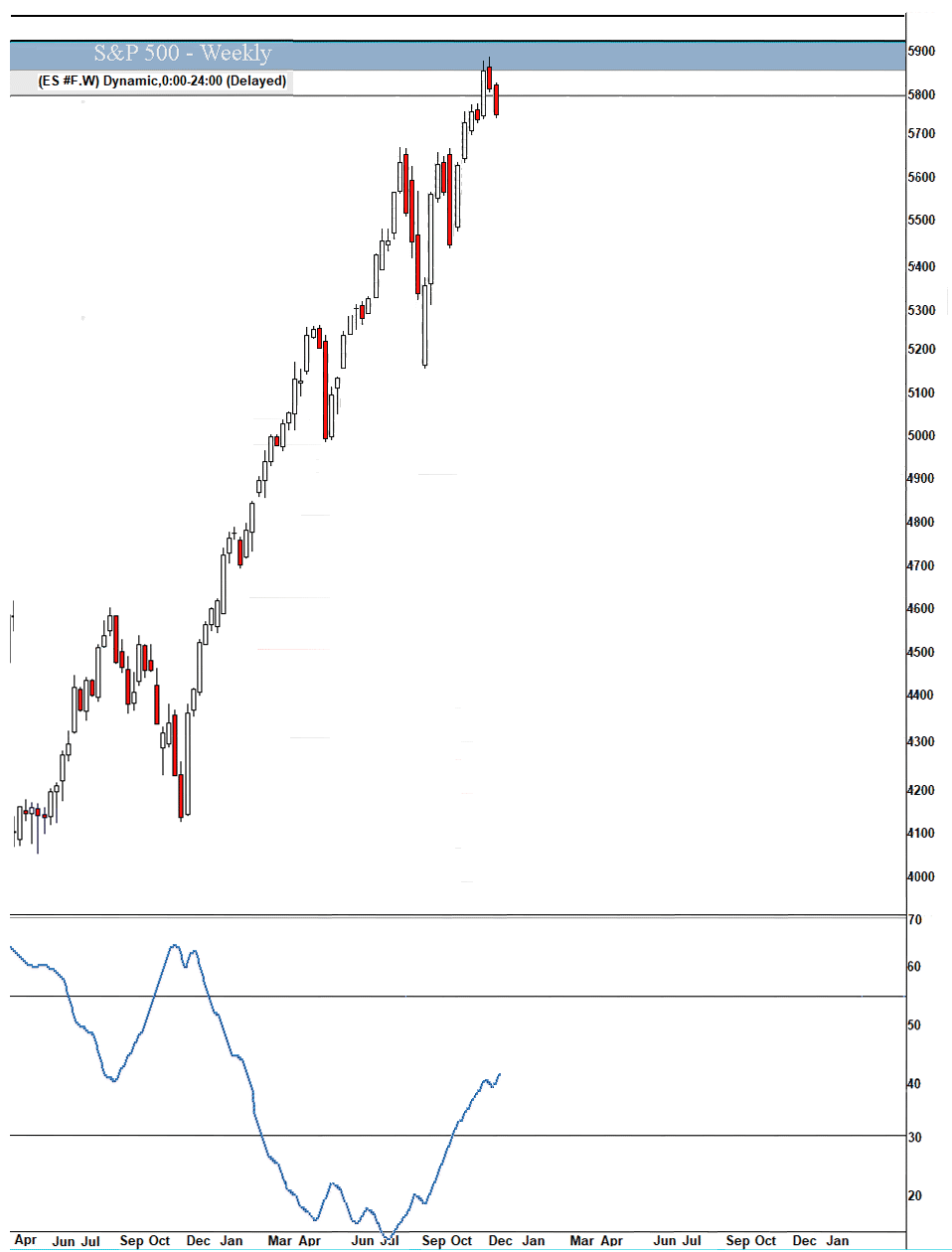

The fractal dimension continued its consolidating ways, still weeks away from being fully consolidated. This seems odd with the election about to be decided unless we are in for another Bush-Gore cliffhanger while the lawyers sort it out.

Below The Paywall This Week

* * A record September quarter

* * A better-than-expected September quarter

* * A very good September quarter

* * A great quarter coming

* * Another great quarter coming

* * A good September quarter with conservative guidance

* * A snappy September quarter

* * A really good September quarter

* * A first contract

* * Hey, Hussein Salami – attacking Israel from Iraq won't fool them

* * A table-pounding Buy recommendation with a $50 one-year target from BofA

* * A new all-time record

* * A yearend target price of $125,000 – this year

Coming Events for Free Subscribers

All times below are EDT.

Sunday, November 3

Time change to Standard Time - 2:00am local time – Turn clocks back one hour until March 9

Tuesday, November 5

Election Day! - Vote for whomever, but vote!

Thursday, November 7

Fed Meeting results - 2:00pm press release; 2:30pm conference call

Golden Age Portfolio Update

This was a consolidation week for the portfolio as it fell 3.5%. We're still up 49.9% with much more to come in 2024 and 2025. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

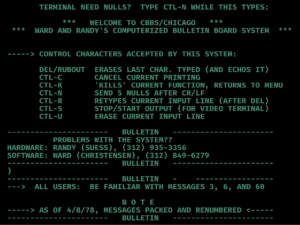

RIP Ward Christensen

h/t This is True

From Honorary Unsubscribe: “In January 1978, the Great Blizzard of 1978 hit Chicago, and Christensen and his friend Randy Seuss were stuck at home. Christensen and Seuss talked on the phone, and Christensen suggested there should be an automated computer system where someone could use a modem to dial up a central computer to upload or download files, which could use his XMODEM file transfer protocol. There wasn’t such a thing, so they decided to build it. Seuss took on building the S-100 hardware components, and Christensen took on the software. “I thought of it being for the club,” Christensen said. “Randy said that just we two should do it — ‘committee projects’ just don’t go anywhere. So we just did it.” It only took three weeks before it went live on February 16, 1978, as CBBS — the Computerized Bulletin Board System. Seuss said it should be at his house since he lived in the middle of Chicago — a free phone call from anywhere else in the city. It was the first-ever computer BBS.”

h/t This is True. I highly recommend a free or paid subscription to This is True.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

The Most Popular Wedding Song

That won Whitney a Grammy in 1988. Second most popular was ABBA's 1976 Dancing Queen.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your still saving wisdom Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.